How To Keep Track Of Bills

A lot of people have trouble managing their finances. They might think they’re doing a good job, but it becomes a struggle to keep up with them all when the bills start coming in.

A lot of times, you can get overwhelmed and just give up. That’s why I want to share some tips for how to keep track of bills so you can manage your money more effectively so that it doesn’t take over your life.

Write Down All Your Bills

Get a notebook or create an excel spreadsheet and write down all of the bills, how much they are each month and when they are due.

This will help you see where your pinch points are, such as whether you could save by getting cheaper car insurance for single parents.

If you don’t already have one, I recommend getting a calendar just for keeping track of your bills. It will keep them more organised than if you just put them all in one place on your calendar.

Do not make it the last thing you do before you go to bed at night! I recommend doing it when your mind is fresh so that if you forget anything, you can add it in right away.

This is important because now that you have all of these bills on paper, you can start seeing how much money is being taken out of your bank account every month. When I get my wage, it’s tempting to spend all of the money there, but doing this will make you realise a lot faster how much is going away and where it’s being spent.

Sometimes we just tend to forget about things, and before you know it, we have spent money on items that should have been kept aside for a bill. If you run a business using managed payroll services can also help this whether you hire 2 people or 2000 people it will take one pressure away from you.

Use Digital Banking

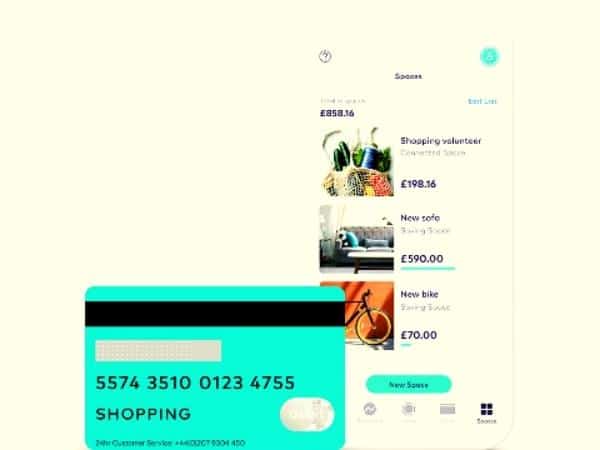

Take advantage of the digital age we are living in and use a digital bank. Banks like Starling Bank have done a terrific job of helping people keep track of their bills.

Simply log into the app, and within a few taps, you can see scheduled direct debits. Within many of these digital banks, you can also take advantage of the separate ‘pots’ and specifically put money to one side for your bills at the start of the month, so you instantly know how much you have got left to spend.

Create a spreadsheet to track how much you owe and when the due date is for each bill.

I recommend putting your bills in order of the amount and how many days it will be before you pay them.

If you want, you can also set a little notation Aside from some of them to remind yourself what payment method you plan on using for that particular bill.

You could use this 50/30/20 budget template to help you plan your money accordingly.

Create a Sinking Fund

A sinking fund is money you set aside every month that will go to a particular bill. They are great for more enormous bills that are less frequent than monthly, for instance, annual car tax or insurance.

How to Set up a Sinking Fund

At the beginning of each month, make sure to take out an amount of money and put it into a separate savings account.

Let’s say your annual car tax is £160. To make your sinking fund, you would place £13.33 into a savings account each month. After 12 months, you will have the exact amount waiting to pay your car tax.

The sinking fund technique could also be applied to Christmas, again if you know how much you would typically spend on gifts, save throughout the year, so you are not wiped out or sent into debt.

Always Set a Direct Debit To Pay Minimum Payment on Credit Cards

Of course, ideally, on anything interest-bearing, you want to pay it off as soon as possible. But if you do have a credit card, ensure you have an automatic direct debit set up. This way, if you forget you have paid for something with your credit card, you will not miss a payment.

Track Your Spending Habits

Now is also the perfect time for you to start watching where your money goes.

I recommend creating a notebook or excel spreadsheet and writing down all the things you spend your money on. If you want, you can also add some columns to the side of things you spend your money on that will be used for savings, like putting money away for a holiday or something else that will be short.

This will show you what areas of your life need improvement, such as

- What bills take up most of your paycheck

- What you spend most of your money on

It will also show you how much money is going toward things you don’t need or even want. I know many times, we end up spending a lot of money on stuff we don’t need, and it hurts us in the long run because we have less to spend on what we need.

Make Sure to Update Your Budget Every Month

Create a habit of updating your budget. Otherwise, it’s just going to feel like something that you’re not going to do or something extra after a while.

I recommend updating your budget at least once a month so that it doesn’t become such a hassle and something you dread doing because the more it feels like an Obligation, the less likely you will be to keep up with it when you Update your Budget.

Go ahead and sit down to think about what bills you have coming up that need money. Think about if anything has changed in your life in the last month, such as a pay cut or something else that might change how much money comes into your bank account.

If it looks like something is changed from the month before, or you just feel like something has changed, go ahead and make the alterations to your budget.

If you have found ways to save money on bills that cost more than they could have if you hadn’t updated your budget, it would also be a good idea to see if those items are still needed in your life because, as we all know, we can always find a way to save more money.

How do I get everything together?

To be as efficient as possible, make sure you have set aside some time on your computer or in an area where you aren’t going to be distracted, such as in a bedroom or something like that. Then, make sure you have all your bills organised, so they are in the order you planned on paying them.

How to Keep Track of Bills- Final Thoughts

If you’re feeling overwhelmed with the number of bills that need to be paid, it might be time for some simple changes. With a few tweaks and habit adjustments, keeping track of money should become easier than ever before.

Start by using digital banking tools like Starling to support a manageable budget plan. Get into the habit of checking your budget throughout the month and understanding your spending habits.

Not only will these habits help make sure all your payments are up-to-date, but they’ll also teach you how much money is coming in and going out each month.

Do you have any tips to keep track of bills? Let me know in the comments below!

About the author

Mary Elizabeth is the founder of MeMoreMoney.com, a Personal Finance website that helps people make their money work harder. She is a self-taught finance nerd and featured Personal Finance Expert in GO Banking Rates and Yahoo! Finance.